In today's fast-paced electronic economy, the need for successful and protected cost answers has skyrocketed. As a result, becoming a Cost Service Provider (PSP) can be a lucrative opportunity for entrepreneurs seeking to enter the financial engineering (FinTech) industry. This comprehensive information will outline the important thing steps and considerations involved in establishing and running a successful Cost Support Provider.

Before fishing into the planet of payment services, it is essential to achieve a strong comprehension of the regulatory environment. Various countries have various rules governing financial transactions, information safety, and conformity standards. Familiarize your self with the appropriate laws and obtain any essential permits or approvals from regulatory how to become a merchant processo.

PSPs may operate in several capabilities, such as for example merchant aggregators, cost gateways, or full-service payment processors. Determine the particular niche and services you would like to offer. Contemplate factors like goal markets, kinds of transactions (online, in-store, mobile), and the industries you plan to serve.

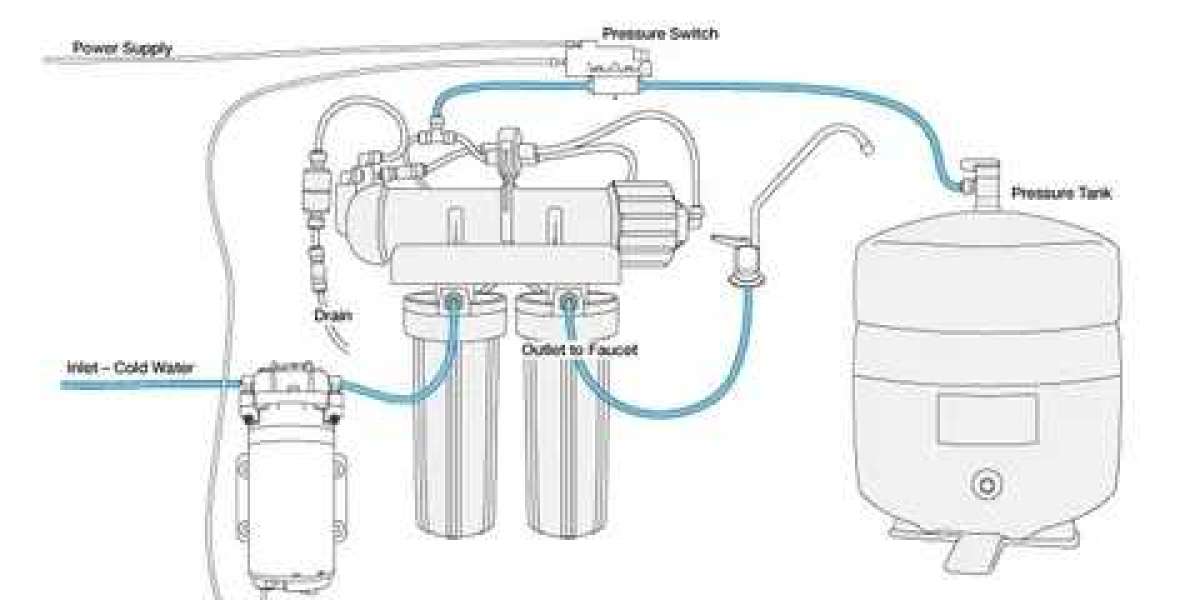

Develop a secure and scalable engineering infrastructure to handle payment transactions. This may include making or partnering with a cost gateway, employing encryption practices, and ensuring compliance with Payment Card Business Information Protection Normal (PCI DSS) requirements.

Forge strategic relationships with financial institutions, card sites, and other critical players in the payment ecosystem. These partners will improve the credibility of your PSP and aid better transaction processing.

Prioritize submission with market criteria and regulations. Apply stringent safety measures to guard sensitive client information and assure the integrity of financial transactions. Often update your methods to stay ahead of developing safety threats.

Support a wide variety of payment techniques and currencies to cater to diverse client needs. Whether it's credit/debit cards, electronic wallets, or alternative cost strategies, giving mobility will entice a more substantial person base.

Style instinctive and user-friendly interfaces for both vendors and end-users. An easy and easy-to-navigate program will improve the overall client experience and inspire customer retention.

Offer outstanding support to handle any dilemmas or concerns promptly. A sensitive customer service staff is essential for maintaining confidence and resolving problems which could develop throughout transactions.

Apply sturdy chance administration programs to find and prevent fraudulent activities. Use advanced analytics and unit understanding algorithms to recognize unusual designs and defend both your company and customers.

Create a solid company presence through successful advertising strategies. Clearly talk the value proposal of your companies to attract vendors and consumers. Establishing a recognizable manufacturer will subscribe to long-term success in the aggressive funds industry.

Being a Payment Support Service requires cautious preparing, adherence to rules, and a responsibility to providing protected and successful economic services. By subsequent these measures and keeping abreast of business developments, entrepreneurs may position themselves to succeed in the active earth of digital payments. As the FinTech landscape continues to evolve, a well-established Cost Company Company can play a essential role in surrounding the ongoing future of financial transactions.