The banking sector is the lifeblood of global finance, holding vast amounts of sensitive financial and personal data. However, this very prominence makes it an attractive target for cybercriminals seeking to exploit vulnerabilities. One emerging threat that has garnered attention is supply chain attacks in the banking sector. In this blog post, we will delve into the mechanics of supply chain attacks, their impact on the banking industry, and the measures institutions can take to mitigate these risks.

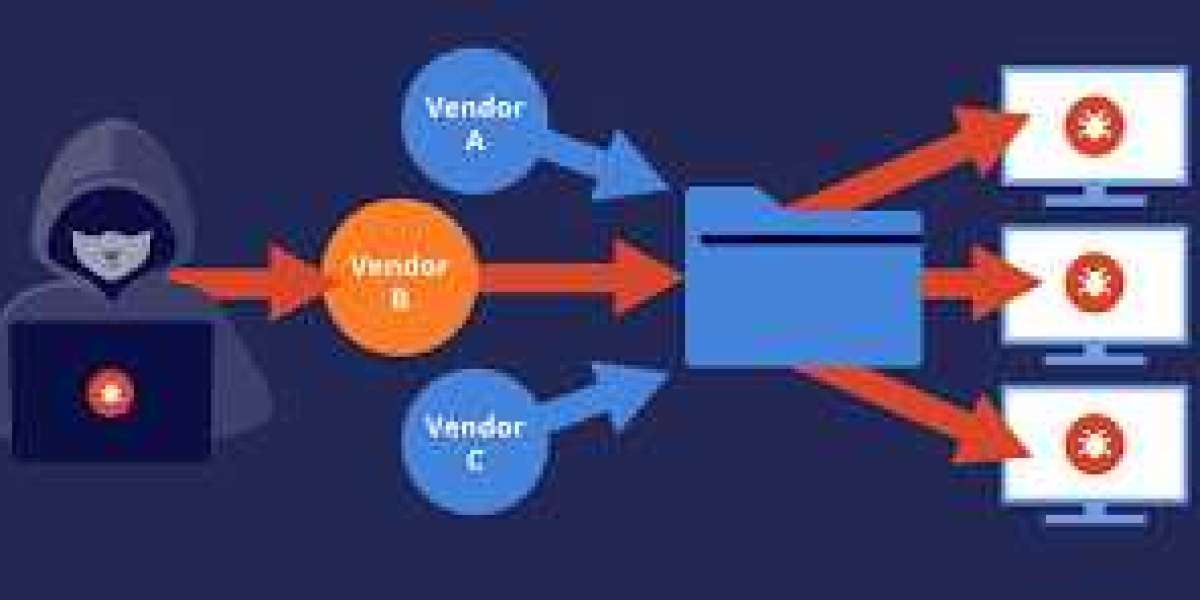

The Anatomy of Supply Chain Attacks in the Banking Sector: A supply chain attack in the banking sector involves exploiting vulnerabilities within the ecosystem of third-party service providers, software vendors, and partners that banks rely on. By compromising these third parties, attackers can gain unauthorized access to sensitive systems, data, or processes of the target bank. These attacks can have far-reaching consequences due to the interconnected nature of financial operations.

The Impact on Banking Institutions:

- Data Breaches: Supply chain attacks can lead to significant data breaches, exposing customer information, financial records, and even proprietary banking algorithms. This can lead to identity theft, fraud, and reputational damage.

- Financial Losses: If attackers manipulate or disrupt financial systems, it can result in monetary losses, operational disruptions, and costly recovery efforts. The financial integrity of the bank and its customers is put at risk.

- Regulatory and Legal Ramifications: Data breaches caused by supply chain attacks can lead to legal actions and regulatory fines. Banks are obligated to safeguard customer data and maintain compliance with data protection laws.

- Trust Erosion: Customers rely on banks to protect their sensitive information. A supply chain attack erodes trust in the bank's ability to secure data, potentially leading to customer attrition.

Mitigating Supply Chain Attack Risks:

- Vendor Risk Management: Banks should thoroughly vet and regularly assess the cybersecurity practices of their third-party vendors. Contracts should include security requirements and incident response plans.

- Supply Chain Audits: Regular audits of supply chain partners help identify vulnerabilities and ensure that security practices are in line with the bank's standards.

- Implement Zero Trust Architecture: Adopt a "zero trust" approach where access to sensitive systems and data is not automatically granted, even to trusted partners. Access should be granted on a need-to-know basis.

- Continuous Monitoring: Employ advanced threat detection and monitoring systems to identify unusual behavior and anomalies within the supply chain ecosystem.

- Employee Training: Educate employees on the risks of supply chain attacks and implement protocols to detect and report suspicious activities.

Supply chain attacks in the banking sector highlight the evolving nature of cyber threats. To safeguard the integrity of financial systems and protect sensitive data, banks must prioritize cybersecurity measures and establish robust strategies for detecting and responding to potential supply chain breaches. By working collaboratively with third-party partners, investing in advanced security technologies, and fostering a culture of vigilance, banks can fortify their defenses against this growing threat and continue to serve as pillars of financial stability and security.