In today’s fast-paced and intricate financial landscape, the role of a financial advisor is more important than ever. These professionals are tasked with helping individuals and businesses manage their financial portfolios, optimize their investments, and navigate the complex world of finance. For this, financial advisor training is a crucial steppingstone to achieving excellence. This article delves into the significance, components, and methods of financial advisor training programs, thereby nurturing skills for financial excellence.

The Significance of Financial Advisor Training

The role of a financial advisor is multi-faceted, requiring a blend of technical knowledge, strategic thinking, and people skills. The constantly changing regulations, products, and client expectations make the need for proper training and ongoing education not a luxury but a necessity. A well-designed financial advisor training program equips professionals with the tools they need to:

Understand the Financial Landscape: Develop a grasp of financial markets, investment products, and tax laws.

Maintain Compliance and Ethics: Stay updated with current regulations and uphold the highest standards of integrity.

Build Client Relationships: Learn the art of communicating effectively with clients, understanding their needs and developing trust.

Craft Sound Investment Strategies: Acquire the skills to construct and manage a diversified investment portfolio tailored to each client’s goals and risk tolerance.

Key Components of Financial Advisor Training

Educational Foundations

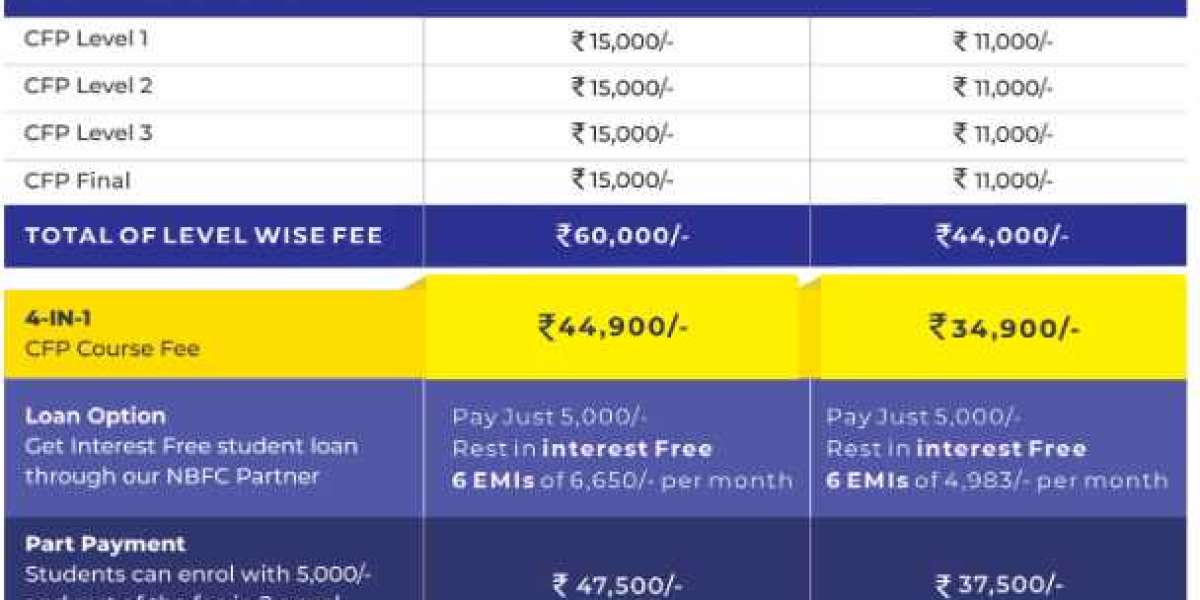

A solid educational background is often the starting point of a financial advisor’s journey. This usually involves a bachelor’s degree in finance, accounting, business, or a related field. For advanced positions, many advisors pursue master’s degrees or certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Licenses and Certifications

Financial advisors need to obtain relevant licenses to practice. This often involves passing exams such as the Series 7 and Series 66 in the United States. There are also various prestigious certifications that advisors can earn to signify their expertise and commitment to the profession, such as CFP, CFA, and Certified Private Wealth Advisor (CPWA).

Hands-On Experience

Experience is the most practical form of training. Many financial advisors start as interns or junior associates where they can learn from senior advisors, interact with clients, and get a feel for the day-to-day tasks involved in this career.

Continuing Education

The financial world is ever evolving. Ongoing training through webinars, workshops, conferences, and courses is critical to stay updated with the latest applications, policies, and regulations.

Methods to Nurture Financial Excellence through Training

Mentorship Programs

Having a seasoned financial advisor as a mentor can be invaluable. They can provide real-world insights, guidance, and feedback that is hard to gain from textbooks alone.

Simulation and Scenario Training

Hands-on, practical exercises that mimic real-life client situations are vital. These can help advisors practice crafting investment strategies and learn how to handle different client personalities and needs.

Soft Skill Development

Being a successful financial advisor isn't just about crunching numbers. Training programs must also focus on nurturing communication, empathy, and relationship-building skills.

Ethics Training

This is a non-negotiable component of financial advisor training. Advisors must be trained to act in the best interests of their clients, which includes understanding and strictly adhering to ethical guidelines.

The Path to Financial Excellence

To nurture skills for financial excellence, aspiring advisors should:

Pursue Formal Education and Certifications: Obtain relevant degrees and certifications that establish credibility and expertise.

Engage in Continuous Learning: Attend seminars, webinars, and conferences to stay updated with the latest industry trends and regulations.

Seek Mentorship and Networking Opportunities: Establish relationships with experienced advisors who can guide your professional development.

Practice Ethical Behavior Relentlessly: Always act in the best interests of your clients and adhere to the highest professional standards.

Conclusion

Financial advisor training is not a one-time event, but a lifelong commitment to learning and professional growth. By diligently pursuing comprehensive, ongoing training, financial advisors can stay at the forefront of their industry, providing invaluable service to their clients and achieving their own professional excellence.

By placing the focus on nurturing skills through effective financial advisor training, professionals are empowered to confidently navigate the complex financial landscape, providing guidance that is both insightful and ethically grounded. In this way, they become not just advisors, but true partners in their clients' financial well-being.