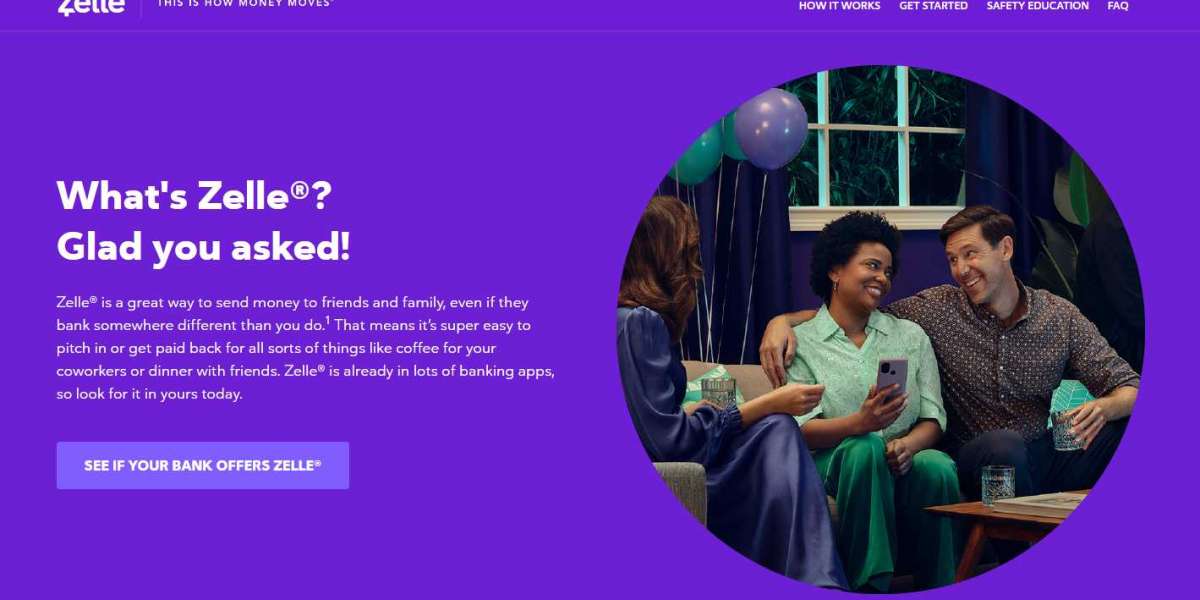

It's called shared (P2P), or one individual to another, installments and incorporates Venmo (presently claimed by PayPal), Square Money, zelle login, and Apple Pay.

One response is that they are for the most part free for the present, expected to begin charging some way or another, sometime in the not so distant future. So they have the "plan of action" that has financial backers paying for your utilization in the expectation you will become acclimated and they will "adapt" it later.

Zelle is one of a kind in that it was created by the 30 banks, including Bank of America, Pursue, Citi, and Wells Fargo. It moves cash between the banks electronically without contacting the actual assets, in contrast to Venmo. That makes it a lot quicker and consistent, secure, and probably more affordable. Appears to require a bank or a check card for shipper and recipient, so perhaps this bumps recent college grads into becoming clients of business banking.

What's more, banks have a strong fascination to close out outsiders.

I was standing by listening to the A16z web recording recently, discussing the approaching unrest in "fintech" (monetary administrations through cutting edge), which Andreesen-Horowitz holds as an approaching blast. One of the points is the expectation that they can tempt clients to extend their utilization, for example Venmo Mastercard; or on the other hand Intuit's obtaining of Mint quite a while back, and Credit Karma last month for $7.1 BILLION. Indeed, even bitcoin is showing esteem, particularly in nations without durable monetary foundation. At the point when I was youthful, Wells gave understudies free financial balances with the expectation they'd become clients forever - - which worked for me, as I was with Wells for a very long time, before they found the delights of client misuse.