Introduction:

As the global economy continues to evolve, investors seek stable and enduring assets to diversify their portfolios. Among the plethora of investment options, gold bars emerge as a timeless symbol of wealth preservation. In this article, we explore the intricacies of buy gold bars, providing insights into the process, considerations, and the enduring appeal of this precious metal.

The Appeal of Gold Bars:

Gold bars have been a coveted investment for centuries, admired for their intrinsic value, stability, and the ability to transcend economic fluctuations. Investors are drawn to gold bars as a tangible asset that holds its worth over time, making them a prudent choice for those looking to safeguard their wealth.

Key Considerations When Buying Gold Bars:

Purity and Authenticity:

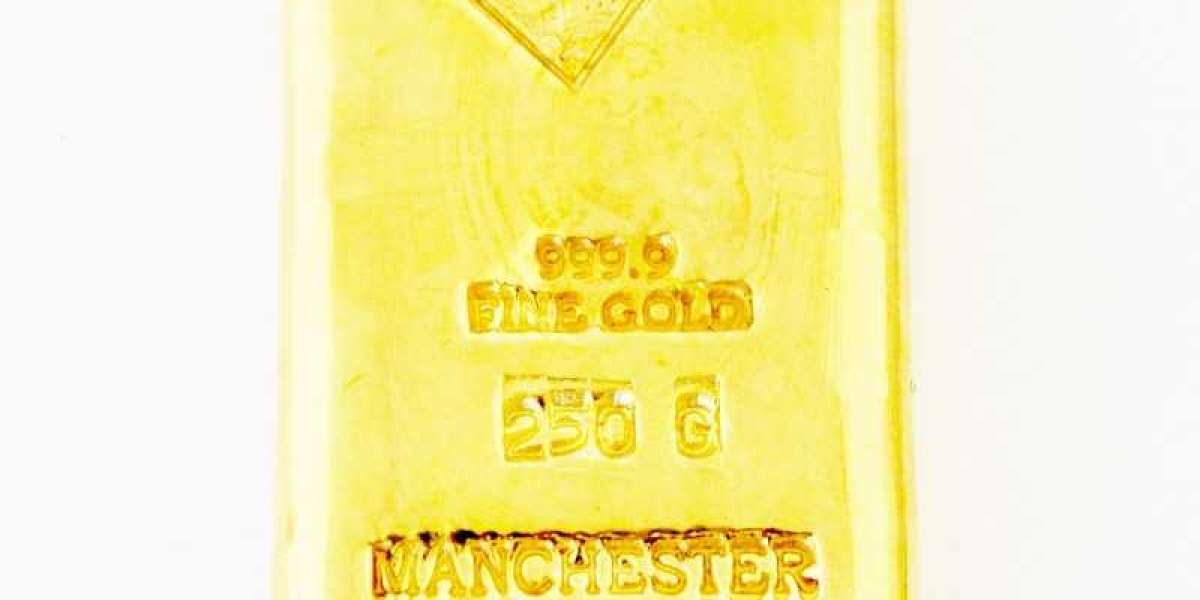

- Verify the purity of the gold bars before purchasing. Reputable mints and refineries produce bars with a high level of purity, often exceeding 99.9%. Look for recognizable hallmarks, mint marks, and unique serial numbers to ensure authenticity.

Reputation of the Seller:

- Choose a reputable seller when buying gold bars. Established bullion dealers, banks, and government mints are reliable sources. Research customer reviews, check for industry certifications, and verify the seller's reputation to ensure a secure transaction.

Weight and Size:

- Gold bars come in various weights and sizes. Consider your budget, storage capabilities, and investment goals when choosing the weight of the gold bars. Common sizes include 1g, 5g, 10g, 1oz, and 1kg, each catering to different preferences and investment strategies.

Market Conditions:

- Stay informed about current market conditions. The price of gold fluctuates based on factors such as global economic trends, geopolitical events, and currency movements. Timing your purchase to coincide with favorable market conditions can maximize your investment potential.

Storage and Security:

- Plan for secure storage before purchasing gold bars. Whether storing them in a secure vault, a private safe deposit box, or a home safe, ensuring the safety of your investment is crucial. Consider insurance options to protect against unforeseen circumstances.

Transaction Costs:

- Be aware of transaction costs associated with buying gold bars. These may include premiums above the spot price, taxes, and shipping fees. Understanding the total cost of acquisition helps avoid unexpected expenses.

Reselling Considerations:

- Anticipate potential future transactions by considering the ease of reselling your gold bars. Well-known brands and popular weights are generally more liquid in the secondary market.

The Process of Buying Gold Bars:

Research:

- Conduct thorough research on the types of gold bars available, reputable sellers, and current market conditions.

Choose a Seller:

- Select a reputable seller with a proven track record. Ensure they provide transparent information about the gold bars they offer.

Make the Purchase:

- Complete the purchase through a secure and trusted buy gold bars platform. Pay attention to payment methods and ensure the transaction is encrypted for added security.

Receive and Verify:

- Upon receiving the gold bars, carefully inspect and verify their authenticity. Check for proper packaging and documentation.

Secure Storage:

- Store the gold bars in a secure and accessible location. Consider insurance to protect your investment against unforeseen events.

Conclusion:

Buying gold bars is a strategic and enduring investment choice. As a tangible asset with intrinsic value, gold bars provide investors with a reliable means of preserving wealth and diversifying portfolios. By understanding key considerations and following a careful buying process, individuals can embark on a journey to unlock the wealth-preserving potential of gold bars.