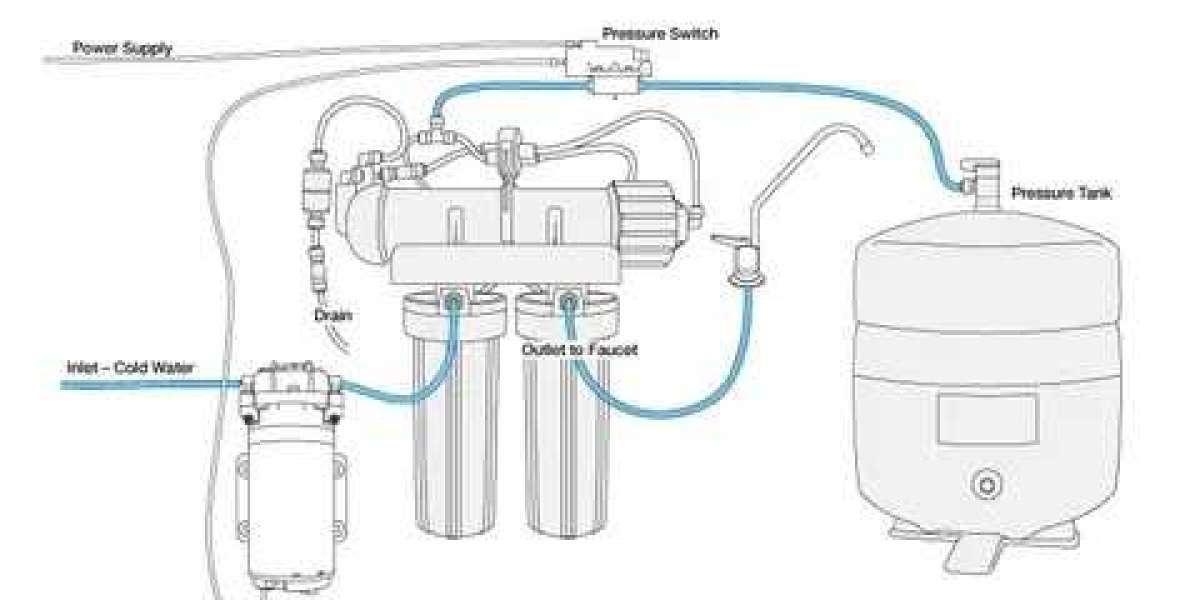

The Reverse Osmosis Pump Market is experiencing a significant surge in demand, owing to the increasing adoption of reverse osmosis units in both residential and commercial settings. As awareness about waterborne contaminants, including coronavirus, protozoans, cysts, viruses, and other microbials, grows, there is a heightened emphasis on water purification systems. Reverse osmosis systems have proven to be highly effective in treating water and ensuring its safety for consumption and various applications. Consequently, the need for reliable and efficient reverse osmosis pumps to facilitate the filtration process has become paramount.

The reverse osmosis pump market is expected to exceed US$ 6.2 billion in 2023, driven by rising applications in the oil and gas and water treatment industries, according to Future Market Insights (FMI). The demand for reverse osmosis pumps is predicted to grow at a CAGR of 9% between 2023 and 2033.

The rising use of reverse osmosis units in both residential and commercial settings is expected to enhance demand for reverse osmosis pumps. Reverse osmosis systems treat water for coronavirus, protozoans, cysts, viruses, and other microbials.

Reverse osmosis pumps are employed in a variety of commercial applications like restaurants, coffee shops, and bars to assure dispenser production without sacrificing quality. The complete reverse osmosis device also regulates beverage flavors by lowering acidity and raising mineral content. The need for clean water, which is required for kitchen sanitation, is raising awareness of reverse osmosis.

Stay Ahead in the Market: Get a Comprehensive Market Overview and Stay Ahead of the Curve - Download Our Sample Now@

https://www.futuremarketinsights.com/reports/sample/rep-gb-11808

The requirement for improved pumps that meet food standard bureau criteria is also boosting the market for reverse osmosis pumps. The use of reverse osmosis pumps in industrial operations reduces environmental harm and expenses associated with wastewater processing.

Key Takeaways

- Over the historical period, the worldwide market grew at a CAGR of 3.5%.

- By 2033, GCC nations will account for more than half of the MEA market.

- In 2023, industrial RO filtering unit applications are expected to account for about 51% of the market in terms of value.

- In 2023, centrifugal pumps will command a market share of more than 70% by value.

- Booster pumps were the most popular, accounting for more than 81.6% of all pumps sold in 2033.

“India’s rapid urbanization has resulted in increased infrastructure investment in the residential and commercial sectors. The increased awareness of the importance of water treatment and usage is likely to drive significant demand for reverse osmosis pumps,” says the FMI analyst.

Competitive Landscape

Companies in the reverse osmosis pump market are working on projects and forming strategic collaborations with other manufacturers in order to improve their products. This will assist them in increasing their product manufacturing capacity in order to meet the demands of a rising industrial consumer base.

- The Sharjah Electricity, Water and Gas Authority (SEWA) completed its project to build the Al Rahmaniya Plant, which uses reverse osmosis (RO), in May 2023 by replacing the old pumping apparatus with an innovative and sophisticated higher-efficiency system that reduces costs of operation, releases carbon dioxide, and uses 35% less power than the old system.

- In May 2023, Tradesales announced a collaboration with Aquapax to develop game-changing technologies that will transform drinking water systems in mining operations.

More Valuable Insights

Future Market Insights, in its new offering, presents an unbiased analysis of the global reverse osmosis pump market presenting a historical analysis from 2018 to 2022 and forecast statistics for the period of 2023 to 2033.

The study reveals essential insights on the basis of technology type, pump type, flow rate, application type and sales channel across five major regions of the world.

Reverse Osmosis Pump Market by Category

By Technology Type:

- Centrifugal Pump

- Single Stage

- Multi-Stage

- Diaphragm Pumps

By Pump Type:

- Booster Pump

- Delivery/Demand Pumps

By Flow Rate:

- 1 to 0.5 GPM

- 5 to 1 GPM

- 1 to 5 GPM

- 5 to 20 GPM

- 20 to 100 GPM

- 100 to 500 GPM

- 500 to 1000 GPM

By Application Type:

- Domestic Commercial

- Filtration Units

- Countertop Filter Cum Demineralizer

- Industrial RO Filtration Unit

- Manufacturing

- Oil and Gas

- Power Generation

- Seawater Desalination Unit

By Sales Channel:

- Online

- Offline

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa